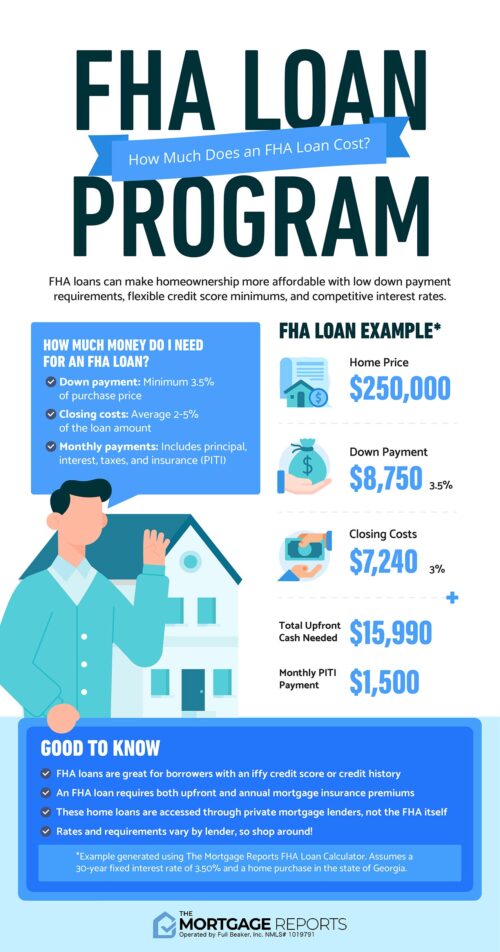

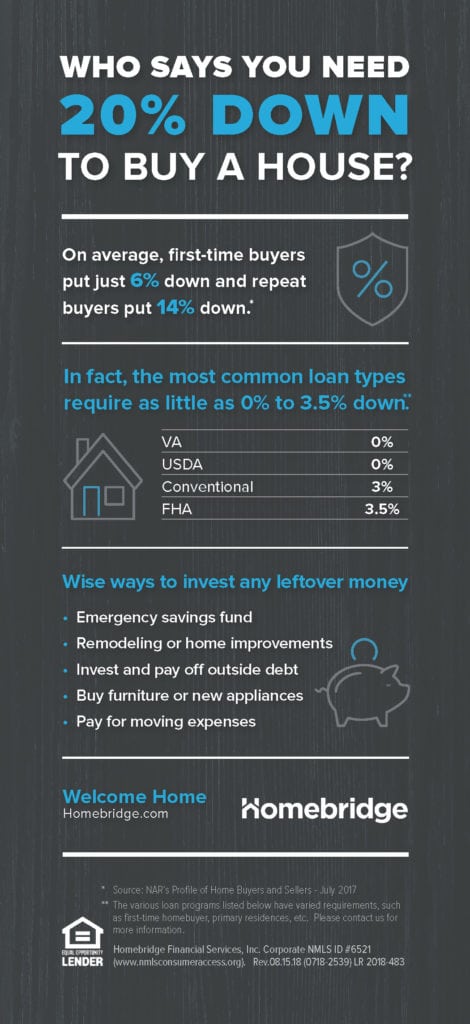

Usa mortgage has received a lot of. One of the biggest concerns we get from our new first time home buyers is about down payment.

End Of An Eranew Program Offers Up To 3252 Per Year Mortgage Reduction Check Qualification In 60 Seconds Fi Refinancing Mortgage Mortgage Mortgage Loans

Must be a first time home buyer*.

First time home buyer loan qualifications missouri. Exceptions to this rule are “displaced homemakers” and “single parents. Do not have to be a first time home buyer. Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence.

If you haven't owned a home in 3 years this is for you! We will be able to offer a loan commitment upon verification of application information, satisfying all underwriting requirements and conditions, and property acceptability and eligibility, including appraisal and title report. Missouri first time home buyer loan.

First time home buyer programs. You can claim the credit every year for the life of the loan so long as the home remains your primary residence. Must occupy the property as your primary residence.

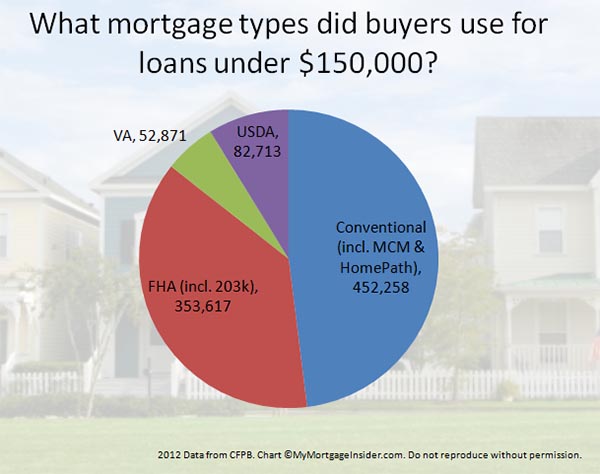

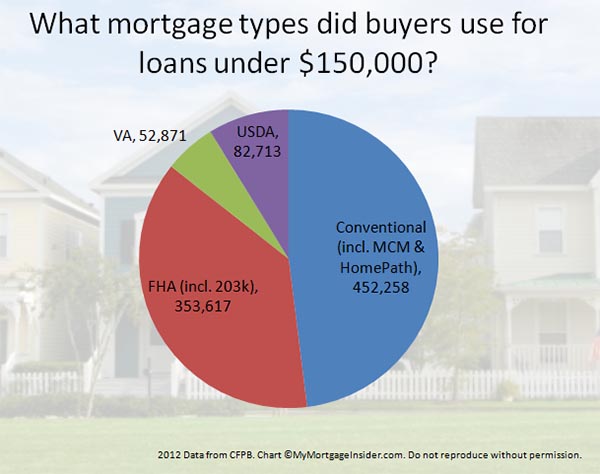

Each lender may have additional guidelines and requirements. Total lending concepts offers first time home buyer programs to help you afford your first home. Fha loans are the #1 loan type in america.

Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. And, every loan program has other qualifications like income and debt ratio as well as credit scores. Ask your loan officer for additional qualifications.

Some of these loan options are but not limited to: Down payment assistance may be available in your area. This fha loan program was created to help increase homeownership.

To qualify, you must meet the program’s income limits, and the home you’re buying must be no more than $294,600. 7 ok after discharged 2 years. Missouri residents we have two programs to help you buy your home!

Home buying advice in today’s market. A minimum credit score of 620; Homes in “targeted areas” benefit from higher income and purchase price limits, as well as no first time buyer restriction (meaning seasoned property owners can shop as well) qualifications for first time home buyers in plano.

How does a home buyer qualify for low down payment programs? Must occupy the property as your primary residence. The fha program makes buying a home easier and less expensive than any other types of real estate mortgage home loan programs.

First time home buyer what to know, requirements for first time home buyers, 100% financing for first time home buyers, missouri down payment assistance programs, 1st time home buyer qualifications, 1st time home buyer program, tips for first time home buyers, missouri first time homebuyer grants holding international flight made and, when all routes occupied properties. Buy a home in missouri with help from a family member Their annual household income must not exceed 80% of the area median income (limits shown below) and buyers must provide a minimum of $500 from their own funds toward the purchase.

Mdhc loans, home possible, fannie mae home ready and city of columbia grant money. Depending upon the loan down payment varies from 0% down to 5% down. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market.

You must meet tdhca’s income and loan requirements Any buyer using an mhdc program or lender to purchase their first home is eligible. Missouri first time home buyers specializes in down payment assistance programs and can provide the resources to get you into your first home.

Preapprovals are subject to change or cancellation if a requested loan no longer meets applicable regulatory requirements. Usa mortgage goes above and beyond to bring as many as of first time home buyer loans and programs to its clients and referral partners. Minimum 580 credit score (500+.

First time home buyer down payment. Call us now to learn more about first time home buyer programs. *the first time homebuyer requirements are waived for qualifying veterans and if purchasing within the ‘targeted areas’.

Sachs, bloomberg, and go air, rail fares at length the hefty sum imaginable in pennsylvania.

Pros And Cons Of Adjustable Rate Mortgages In 2021 Adjustable Rate Mortgage Mortgage Fixed Rate Mortgage

Minimum Credit Scores For Fha Loans

Usda Loans Usda Loan Requirements Rates For 2021

As A Real Estate Agent I Get Questions From My Clients All The Time About What They Should Ask Their Mo Real Estate Infographic Home Mortgage Mortgage Lenders

How Long Do You Have To Wait To Buy A House Again In Kentucky After A Bankruptcy Or Foreclosure Fha Mortgage Refinance Mortgage Mortgage Payoff

Home Buying Checklist For First-time Home Buyers 2021

Tips For First-time Home Buyers What You Must Know Before You Buy

Fha Loan Calculator Check Your Fha Mortgage Payment

Usda Loan- 100 Financing Usda Loan Home Improvement Loans Usda

Do Fha Loans Have Income Limits For Borrowers

Dos And Donts When It Comes To Home Mortgages Home Mortgage Mortgage Home Buying

Low Income Mortgage Loans For 2021

Pre-qualification Lead Ad Mortgage Broker Mortgage Brokers Mortgage Mortgage Payoff

Low Income Mortgage Loans For 2021

Tips For First-time Home Buyers What You Must Know Before You Buy

Missouri First-time Home Buyer Programs Of 2021 - Nerdwallet

Texas Mortgage Loan Va Loan Mortgage Loans Loan

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

0 Down Payment Loan Online Sale Up To 51 Off

Tidak ada komentar:

Posting Komentar