Getting you first home is one of the most exciting times in your life, you’re taking a huge step forward as you begin climbing the property ladder. All forms of ownership in the legal systems of the rest of the uk which are equivalent to ownership in scotland are treated as ownership for the purposes of this relief.

These Are The 10 Least Affordable Areas In Scotland For First-time Home Buyers The Scotsman

Launched to help people buy their own home, it’s divided into two parts:

First time home buyer scotland. A prominent shared equity scheme in scotland is the scottish government's low cost initiative for first time buyers (lift). Followed by mole valley, surrey (39.1%); The scheme will remain open until 31 march 2021 and will provide £150 million of assistance to first time buyers, either as sole or joint applicants.

Applications for the affordable new build part of the scheme closed on 5 february 2021. The first home fund is a shared equity scheme which allows first time buyers to purchase their new home with assistance from the scottish government. Ad contact our specialists for expert advice you need to purchase your property.

Easily compare mortgage rates and deals. You can begin your full mortgage application over the phone or in a bank of scotland branch: Our scottish mortgage advisers are available to help and make the process run smoothly, from applying for a.

New supply shared equity (nsse). The scheme initally opened for applications on 18th december 2019 and then again on 1st april 2021. Contact our friendly team today.

Take a look at our first time buyer mortgage rates, including 5% deposit and cashback mortgages, and compare monthly repayments. Compare mortgage rates and monthly repayments. These will be available from later this year until 2021.

It is part of the government’s homebuy low cost. This consists of new build properties, either built by a housing association or bought by the housing association from. Scotland launches first home fund.

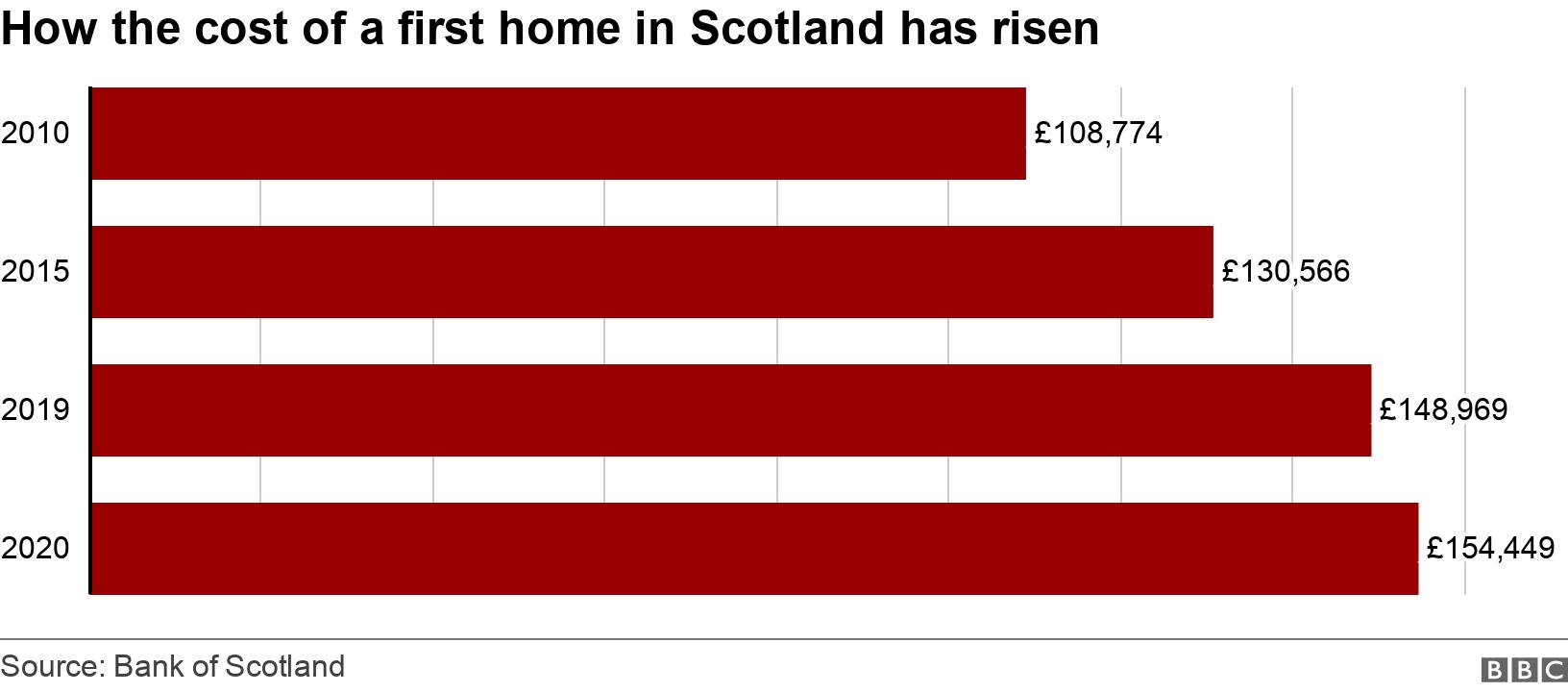

First time buyers in scotland will receive financial help from the scottish government to buy a property under a recently launched pilot scheme. That is, unless you're in the very rare but fortunate circumstance of being able to buy outright. This sum can cover up to 49% of the value of the home.

Contact our friendly team today. There will be no restriction on types of property, no upper limit to the value of properties. The first home fund provides loans of up to £25,000 to first time buyers to help boost their deposit to purchase a property in scotland.

The scheme is expected to help at least 6,000 buyers get onto the property. The idea is that banks and building societies will be reassured to lend and you will get access to the more favourable mortgage rates typically associated with a 25% deposit. Low cost initiative for first time buyers:

Get an indication of the monthly repayment. Mortgages are a loan from your bank or building society and typically stretch up to 40 years in length. Recent figures show that the number of young people.

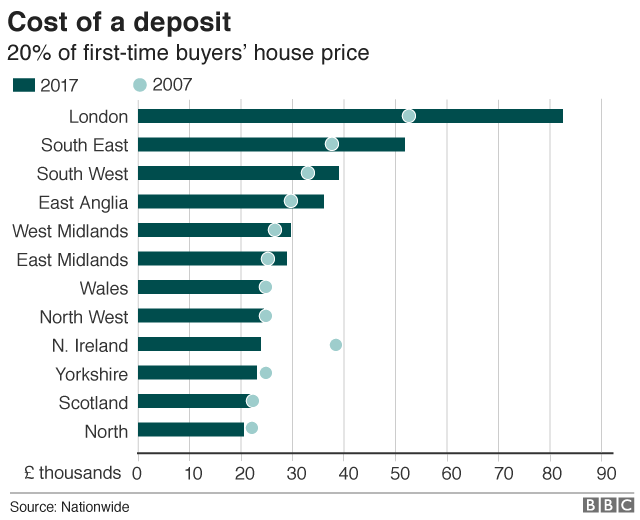

Enter a few details into our mortgage rate calculator and we’ll show you all the. Call us on 0345 300 2297. The scottish government have also announced plans for first time buyers in scotland to be offered loans of up to £25,000 to put towards their deposits as part of a range of measures to make it easier for young people to get a foot on the housing ladder.

The first time buyers’ initiative (ftbi) aims to make more affordable homes available to first time buyers priced out of the housing market. The amount you can borrow will usually be based on two main factors. What you need to know.

Ad contact our specialists for expert advice you need to purchase your property. A multiple of your (and possibly your partner’s) income or a similar assessment to ensure you can afford the repayments.

First Home Fund Bellway

.png?la=en&h=958&w=1438&mw=1438&hash=4D08321AB6BFF6AD1AF20A24E51F1174)

First Home Fund Taylor Wimpey

Rpnk8bydcetwbm

First-time Buyers In Scotland At Seven-year-low - Bbc News

How To Raise A Deposit For First Time Home Buyers Moneysupermarket

Seven Things Every First-time Homebuyer Needs To Know About The Property Market - Daily Record

First Time Buyer Guide Buying A Home In Scotland Espc

First Time Buyer Guide Buying A Home In Scotland Espc

The Cost Of Buying Your First Home Moneysupermarket

The Cost Of Buying Your First Home Moneysupermarket

The Cost Of Buying Your First Home Moneysupermarket

Why Buying A Home In Scotland Is Different To In England And Wales - Zoopla

Buying A Home How Long Does It Take To Save A Deposit - Bbc News

How Much Deposit Do You Need To Buy A House - Newcastle Building Society

Buying A Home Trends In Home Ownership And Scottish Government Support Spice Spotlight Solas Air Spice

First Time Buyer Guide Buying A Home In Scotland Espc

Scotlands First Home Fund Everything You Need To Know Espc

First Time Buyer Guide Buying A Home In Scotland Espc

Scottish Government Urged To Restart Help To Buy For First-time Homeowners Heraldscotland

Tidak ada komentar:

Posting Komentar